If you re claiming an energy tax credit for a new roof you may qualify if your roof meets certain energy requirements.

Qualified roof coating for irs energy credits.

Under the current rules these tax credits become worth less each year.

There is a.

These instructions like the 2018 form 5695 rev.

A tax credit is an amount that a taxpayer can deduct from the amount owed at tax time.

Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

The amount of a roofing tax credit may vary but is generally a portion of the total cost spent on re roofing with a maximum limit on the amount to be paid out.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

For systems installed after this date but before january 1 st 2021 the credits are worth 26.

Learn more and find products.

If you are replacing or adding on to your existing roof you may qualify for an energy efficient home improvement tax credit through energy star.

For upgrades installed before december 31 st 2019 the full 30 tax credit applies.

Homeowners may be eligible for a tax credit if they install a more energy efficient roof.

Including qualified insulation windows doors and roof.

Homeowners may qualify for a federal tax credit for installing certainteed energy star qualified roofing products.

The future of green energy tax credits.

10 of cost note.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

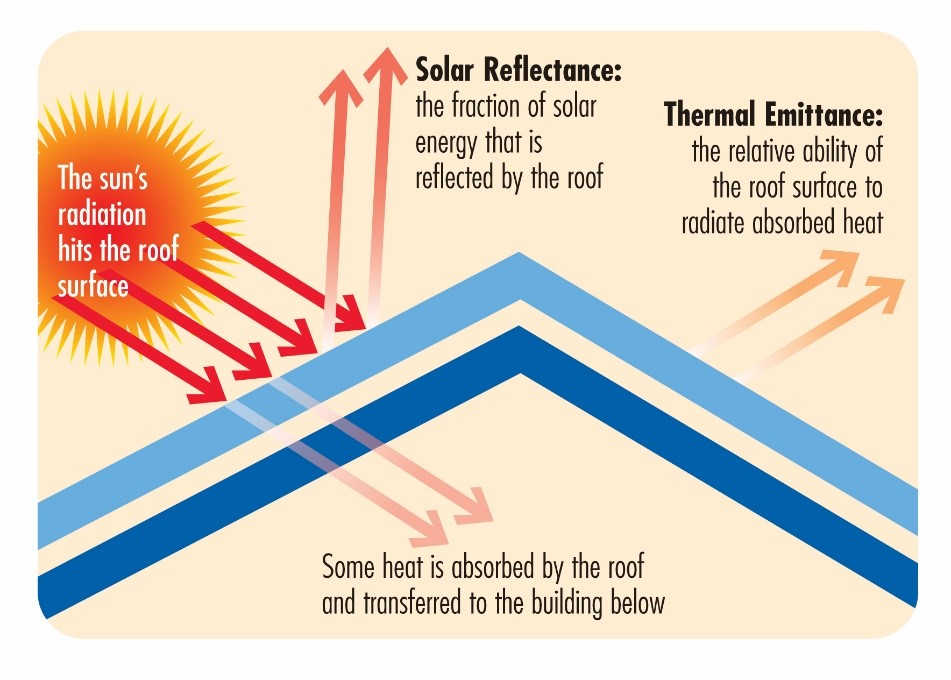

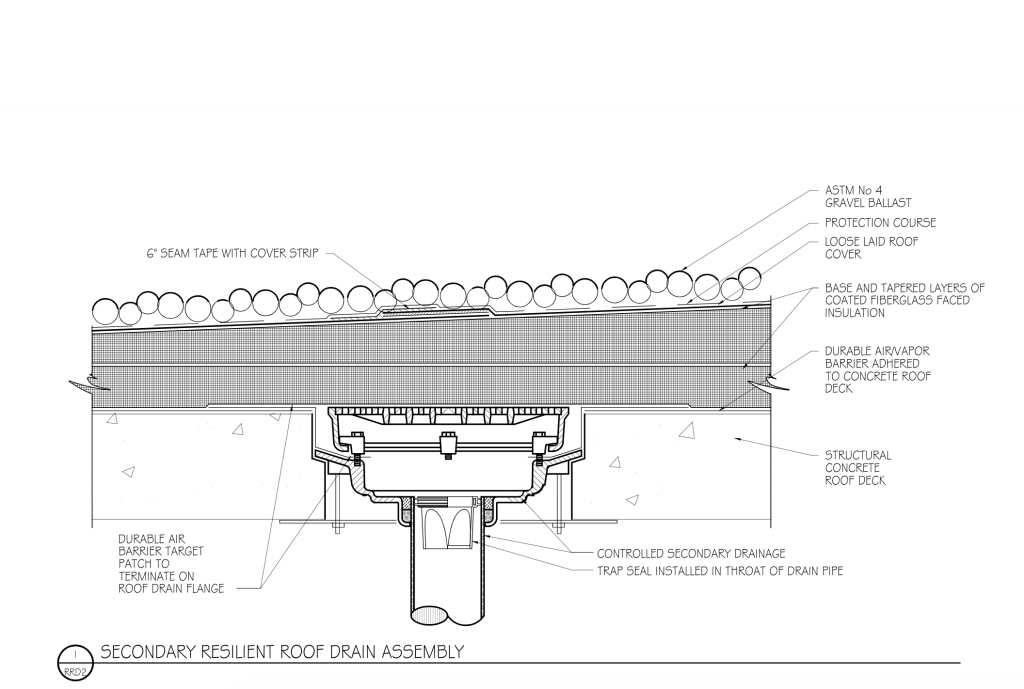

But in order to qualify your new roof must include certified metal or asphalt with pigmented coatings or cooling granules that are.

This tax credit has unfortunately expired but you can still claim it for tax years prior to 2018 if you haven t filed yet or if you go back and amend a previous year s tax return.

There is a total combined credit limit of 500 for all purchases improvements.

Use these revised instructions with the 2018 form 5695 rev.

We generated this list by looking at energystar qualified shingles whose manufacturers provide a manufacturers certification statement claiming that their shingles qualify.

The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.